Welcome to our Cross-Price Elasticity Calculator webpage. This powerful tool allows you to analyze the relationship between product prices and the resulting changes in demand. By inputting the price and quantity data for two products, you can calculate the cross-price elasticity and gain insights into their market dynamics. Whether you want to determine if products are substitutes or complements, or simply understand the impact of price changes, our calculator provides valuable information for strategic decision-making. Explore the fascinating world of cross-price elasticity and uncover the connections between pricing and consumer behavior with ease.

Elasticity:

Interpretation:

Explanation of Interpretation:

What is a Cross Price Elasticity Calculator?

A Cross Price Elasticity Calculator is a tool used to calculate the cross-price elasticity of demand between two products. Moreover, cross-price elasticity measures the responsiveness of the quantity demanded of one product to a change in the price of another product.

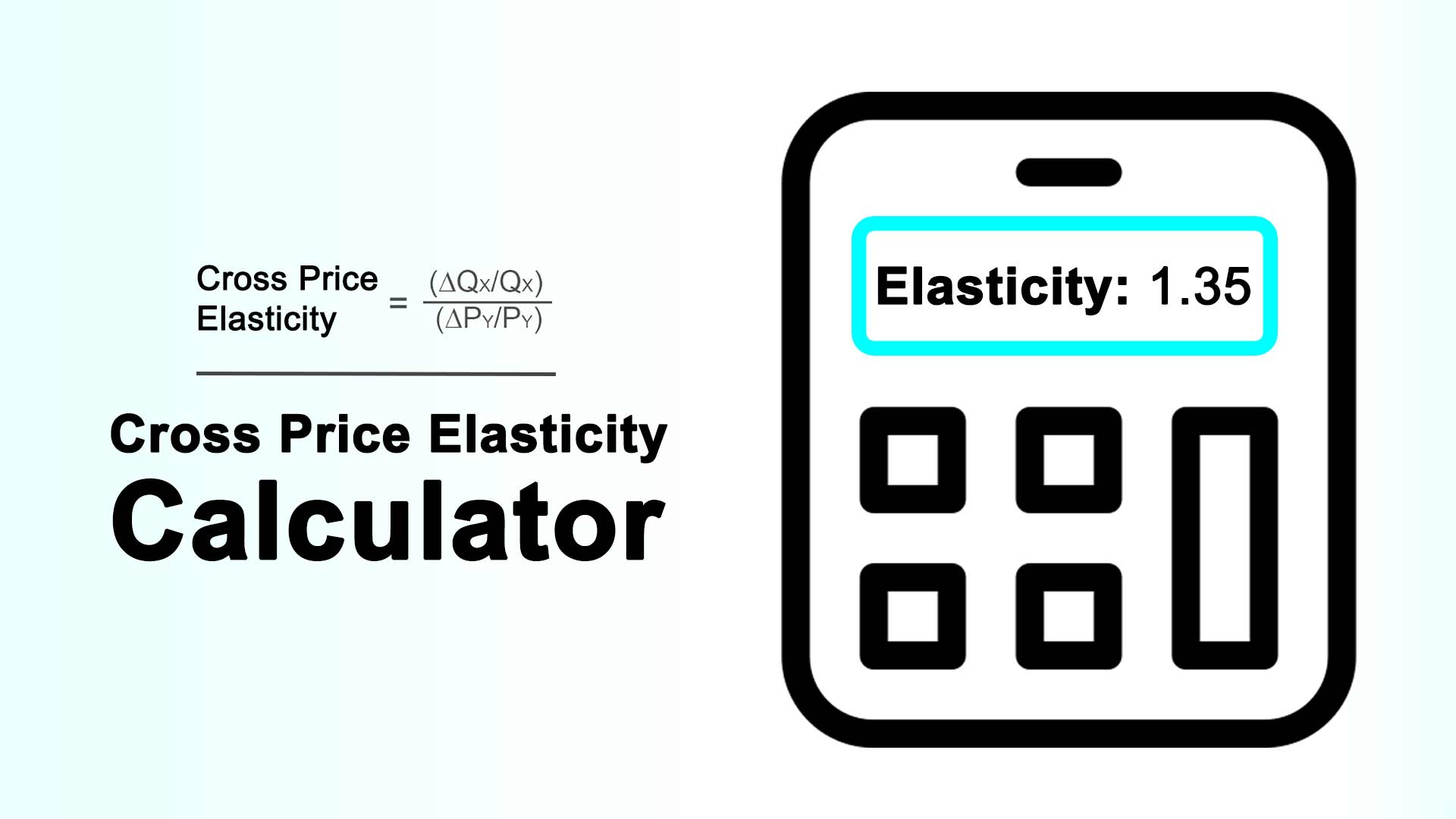

The calculator takes the prices and quantities of two products at two different time points as inputs. Then, it uses the formula for cross-price elasticity to calculate the elasticity value. The cross-price elasticity formula is:

Cross Price Elasticity = ((Quantity of Product 2 at Time Point B – Quantity of Product 2 at Time Point A) / ((Quantity of Product 2 at Time Point B + Quantity of Product 2 at Time Point A) / 2)) / ((Price of Product 1 at Time Point B – Price of Product 1 at Time Point A) / ((Price of Product 1 at Time Point B + Price of Product 1 at Time Point A) / 2))

The calculator displays the calculated elasticity value and provides an interpretation of the elasticity based on its magnitude. Moreover, it determines whether the two products are substitutes (positive elasticity), complements (negative elasticity), or unrelated (zero elasticity).

Additionally, the calculator provides an explanation of the interpretation to help understand the impact of price changes on the quantity demanded of the products.

By using a Cross Price Elasticity Calculator, businesses and economists can gain insights into the relationships between different products and make informed decisions regarding pricing, marketing strategies, and product positioning.

How does this cross price elasticity calculator work?

Based on extensive research and suggestions from Professors of Economics, we have created this cross price elasticity demand calculator. This Cross Price Elasticity Calculator allows you to calculate the cross-price elasticity of demand between two products based on the provided inputs. Here’s how it works:

- Input Section:

- “Price of Product 1 at a time point A”: Enter the price of Product 1 at a specific time point, such as the initial price.

- “Price of Product 1 at a time point B”: Enter the price of Product 1 at a different time point, such as the final price.

- “Demand of Product 2 at a time point A”: Enter the quantity demanded of Product 2 at the initial time point.

- “Demand of Product 2 at a time point B”: Enter the quantity demanded of Product 2 at the final time point.

- “Time Range in Days”: Enter the time duration or range between the two time points in days.

- Calculation:

- Click the “Calculate” button to initiate the calculation.

- The calculator uses the provided inputs to calculate the cross-price elasticity using the formula mentioned earlier.

- The calculated cross-price elasticity value is displayed in the “Elasticity” section.

- Interpretation and Explanation:

- The calculator determines the interpretation of the cross-price elasticity based on the calculated value.

- The interpretation is displayed in the “Interpretation” section.

- Additionally, the calculator provides an explanation of the interpretation in the “Explanation of Interpretation” section.

- The explanation helps you understand the impact of price changes on the quantity demanded of the products based on their relationship.

- Clearing Inputs and Outputs:

- If you want to start fresh and clear all the input values and calculation results, you can click the “Clear” button.

- This will reset all the input fields and clear the calculated values.

Summary of the calculator

By using this Cross Price Elasticity Calculator, you can analyze the relationship between two products and understand whether they are substitutes, complements, or unrelated based on their price and demand changes over a specific time range.

Algorithm and data sources of this Cross Price Elasticity Calculator

We have created this cross-price elasticity of demand calculator based on the suggestion from the Professors on Economic. Professors including, Robert Metcalfe, Stephen Quinn and Zachary Smith helped us to create the algorithm. Additionally, they also validated the performance and accuracy of this Cross Price Elasticity Calculator. We got good feedback from them.

Moreover, we have taken knowledge from different scientific papers. Some of the papers are enlisted below:

- Estimation of own- and cross-price elasticities from household survey data

- Empirical assessment of energy-price policies: the case for cross-price elasticities

- Does Price Elasticity Vary with Economic Growth? A Cross-Category Analysis

- Cross-Price Elasticities of Demand Across 114 Countries

- Cross-price elasticities and their determinants: a meta-analysis and new empirical generalizations

- Price elasticity of demand of non-cigarette tobacco products: a systematic review and meta-analysis

- Estimating Cross-Price Elasticity of E-Cigarettes Using a Simulated Demand Procedure

- Direct and cross price elasticities of demand for gasoline, diesel, hybrid and battery electric cars: the case of Norway

How to find cross price elasticity?

To find the cross-price elasticity of demand between two products, you can follow these steps:

Identify the two products:

Determine which two products you want to analyze in terms of their cross-price elasticity. For example, let’s consider Product A and Product B.

Gather data:

Collect data on the prices and quantities demanded of both products at two different time points. This information should include the price of Product A at both time points (denoted as P1 and P2) and the quantity demanded of Product B at both time points (denoted as Q1 and Q2).

The percentage change in price calculation:

Calculate the percentage change in the price of Product A using the following formula: Percentage Change in Price = ((P2 – P1) / ((P1 + P2) / 2)) * 100

The percentage change in quantity demanded calculation:

Calculate the percentage change in the quantity demanded of Product B using the following formula: Percentage Change in Quantity Demanded = ((Q2 – Q1) / ((Q1 + Q2) / 2)) * 100

The cross-price elasticity calculation:

Divide the percentage change in the quantity demanded of Product B by the percentage change in the price of Product A to find the cross-price elasticity: Cross-Price Elasticity = (Percentage Change in Quantity Demanded / Percentage Change in Price)

Interpret the cross-price elasticity:

Based on the value of the cross-price elasticity, interpret the relationship between the two products:

- If the cross-price elasticity is positive, the products are considered substitutes. This means that an increase in the price of one product leads to an increase in the quantity demanded of the other product, and vice versa.

- If the cross-price elasticity is negative, the products are considered complements. This means that an increase in the price of one product leads to a decrease in the quantity demanded of the other product, and vice versa.

- If the cross-price elasticity is close to zero, the products are considered unrelated. This indicates that changes in the price of one product have little to no impact on the quantity demanded of the other product.

Cross price elasticity formula with example

The cross-price elasticity of demand measures the responsiveness of the quantity demanded of one product to a change in the price of another product. The formula for cross-price elasticity is:

Cross-Price Elasticity = ((Q2 – Q1) / ((Q1 + Q2) / 2)) / ((P2 – P1) / ((P1 + P2) / 2))

Where:

- Q1 and Q2 are the quantities demanded of the product in question at two different time points.

- P1 and P2 are the prices of the other product at the same two time points.

Example

Let’s consider an example to illustrate the calculation of cross-price elasticity:

Product A is a soft drink, and Product B is a snack. We want to calculate the cross-price elasticity of demand for Product A with respect to the price of Product B.

At Time Point 1:

- Price of Product A (P1) = $1.50

- Quantity demanded of Product A (Q1) = 100 units

- Price of Product B (P1) = $2.00

At Time Point 2:

- Price of Product A (P2) = $1.80

- Quantity demanded of Product A (Q2) = 80 units

- Price of Product B (P2) = $1.50

Now, we can calculate the cross-price elasticity:

Percentage Change in Quantity Demanded = ((Q2 – Q1) / ((Q1 + Q2) / 2)) * 100 = ((80 – 100) / ((100 + 80) / 2)) * 100 = (-20 / 90) * 100 = -22.22%

Percentage Change in Price = ((P2 – P1) / ((P1 + P2) / 2)) * 100 = ((1.80 – 1.50) / ((1.50 + 1.80) / 2)) * 100 = (0.30 / 1.65) * 100 = 18.18%

Cross-Price Elasticity = (Percentage Change in Quantity Demanded / Percentage Change in Price) = (-22.22% / 18.18%) = -1.22

The cross-price elasticity of demand for Product A with respect to the price of Product B is -1.22. Since the elasticity is negative, we can interpret it as follows: a 1% increase in the price of Product B leads to a 1.22% decrease in the quantity demanded of Product A. This suggests that Product A and Product B are complements. They are typically consumed together. Moreover, a change in the price of one has an opposite effect on the demand for the other.

What is the cross price elasticity midpoint formula?

The cross-price elasticity midpoint formula is an alternative calculation method for cross-price elasticity that addresses the issue of different magnitudes of price and quantity changes. Moreover, it uses the midpoint of the initial and final price and quantity values to calculate the percentage changes.

The formula for cross-price elasticity using the midpoint method is:

Cross-Price Elasticity = ((Q2 – Q1) / ((Q1 + Q2) / 2)) / ((P2 – P1) / ((P1 + P2) / 2))

This formula is similar to the standard cross-price elasticity formula. However, it uses the average of the initial and final values for both price and quantity. Moreover, it ensures that the percentage changes are calculated relative to the midpoint of the two values, reducing bias that may arise when using only the initial or final values.

Using the midpoint formula provides a more accurate measure of elasticity when there are significant changes in price and quantity over the analyzed period. Additionally, it is particularly useful when dealing with large percentage changes or when the direction of change is not clear.

By applying the midpoint formula, you can obtain a more precise estimation of the cross-price elasticity, taking into account the relative changes between the midpoint values of price and quantity demanded.

Example of cross price elasticity midpoint formula

Let’s consider an example to illustrate the calculation of cross-price elasticity using the midpoint formula:

Product A is a laptop, and Product B is a laptop bag. Now, we want to calculate the cross-price elasticity of demand for Product A with respect to the price of Product B.

At Time Point 1:

- Price of Product A (P1) = $1000

- Quantity demanded of Product A (Q1) = 200 units

- Price of Product B (P1) = $50

At Time Point 2:

- Price of Product A (P2) = $1200

- Quantity demanded of Product A (Q2) = 150 units

- Price of Product B (P2) = $40

Using the cross-price elasticity midpoint formula, we can calculate the elasticity:

Percentage Change in Quantity Demanded = ((Q2 – Q1) / ((Q1 + Q2) / 2)) * 100 = ((150 – 200) / ((200 + 150) / 2)) * 100 = (-50 / 175) * 100 = -28.57%

Percentage Change in Price = ((P2 – P1) / ((P1 + P2) / 2)) * 100 = ((1200 – 1000) / ((1000 + 1200) / 2)) * 100 = (200 / 1100) * 100 = 18.18%

Cross-Price Elasticity = (Percentage Change in Quantity Demanded / Percentage Change in Price) = (-28.57% / 18.18%) ≈ -1.57

The cross-price elasticity of demand for Product A with respect to the price of Product B, calculated using the midpoint formula, is approximately -1.57. This indicates that a 1% increase in the price of the laptop bag (Product B) is associated with a 1.57% decrease in the quantity demanded of laptops (Product A). Based on this result, we can infer that these two products are complements. This is evident as an increase in the price of the laptop bag leads to a relatively larger decrease in the demand for laptops.

What does negative cross price elasticity mean?

A negative cross-price elasticity indicates that two products are complements. In this case, an increase in the price of one product leads to a decrease in the quantity demanded of the other product, and vice versa. Moreover, the negative sign indicates an inverse relationship between the prices and quantities demanded of the two goods.

Example of negative cross price elasticity

Let’s consider an example to illustrate this:

Product X is coffee, and Product Y is creamer. We want to determine the cross-price elasticity of demand for coffee with respect to the price of creamer.

At Time Point 1:

- Price of coffee (P1) = $5

- Quantity demanded of coffee (Q1) = 100 bags

- Price of creamer (P1) = $2

At Time Point 2:

- Price of coffee (P2) = $6

- Quantity demanded of coffee (Q2) = 80 bags

- Price of creamer (P2) = $2

Using the cross-price elasticity midpoint formula, we can calculate the elasticity:

Percentage Change in Quantity Demanded = ((Q2 – Q1) / ((Q1 + Q2) / 2)) * 100 = ((80 – 100) / ((100 + 80) / 2)) * 100 = (-20 / 90) * 100 = -22.22%

Percentage Change in Price = ((P2 – P1) / ((P1 + P2) / 2)) * 100 = ((6 – 5) / ((5 + 6) / 2)) * 100 = (1 / 5.5) * 100 ≈ 18.18%

Cross-Price Elasticity = (Percentage Change in Quantity Demanded / Percentage Change in Price) = (-22.22% / 18.18%) ≈ -1.22

The negative cross-price elasticity of demand for coffee with respect to the price of creamer (approximately -1.22) indicates that these two products are complements. If the price of creamer increases by 1%, we would expect a decrease in the quantity demanded of coffee by approximately 1.22%. Similarly, a decrease in the price of creamer would result in an increase in the quantity demanded of coffee. Moreover, the negative sign implies an inverse relationship between the prices and quantities demanded of coffee and creamer, confirming their complementary nature.